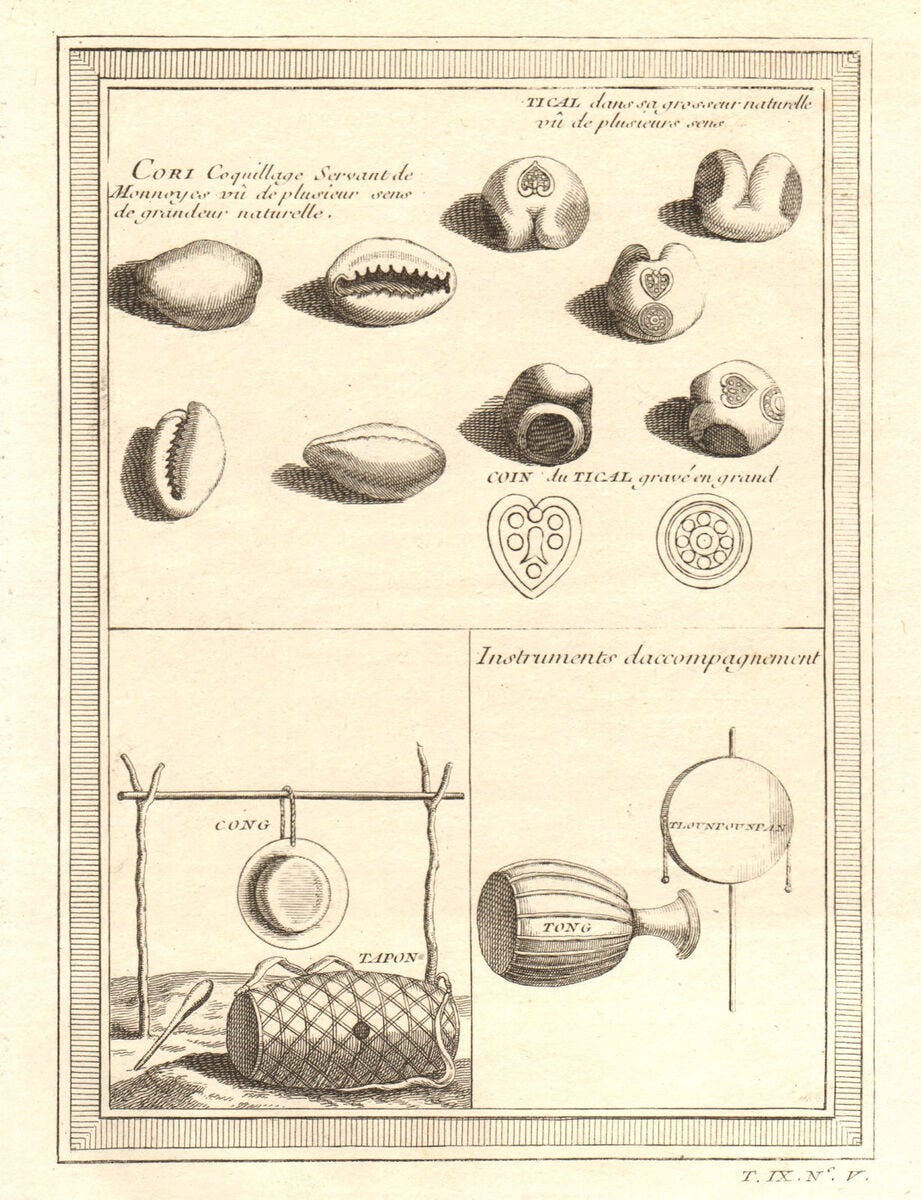

Did you know that some of the earliest currencies were natural objects? Before Amex points and long before Bitcoin, people traded commodities like shells, livestock and even salt. In fact, the word salary comes from the Latin salarium, which refers to the salt rations given to Roman soldiers as their wages. Pretty interesting, right?

With the ability to buy more and more with instant online payments and the tap of our phones, it’s easy to forget that money actually exists in physical form, not forgetting the various physicalities it has taken over the centuries.

To take on the task of giving you a complete history of money would be not too dissimilar from describing the history of civilisation. And with four night shifts ahead of me as I begin to write this, I’m going to spare myself that feat and instead share with you some of the most eye-opening facts about your hard-earned cash…

The British Pound is the world’s oldest currency

Although the very first standardised currency was believed to be cowrie shells, used by the Chinese for their small size and durability, the British £ is the oldest currency still in continuous use. It was originally based on the weight of one pound of silver, hence the name, pound.

In contrast, the world’s newest currency is the ‘ZiG’ - Zimbabwe Gold - which was rolled out last year to address the spectacular 2009 collapse of the Zimbabwe dollar due to hyperinflation, one of the world's worst currency crashes to date.

If you’re a coin collector, you could be sitting on a (literal) goldmine

Before the Second World War in the United Kingdom and pre-1965 in the United States, coins were made of actual silver with a composition of as high as 92.5%, which is where the definition of ‘sterling silver’ comes from.

When the value of silver soared to an all-time high between 1979 and 1980, there was a huge wave of people melting down their coins because silver was worth more than an individual coin’s face value.

But wait, we can do better. In the form of pure gold…

The Indian ‘Mohur’ coin is one of the most famous coins of all time and, even today, remains a symbol of wealth. It was issued by the British Raj Empire and its co-existing states, with antique coins re-selling for tens of thousands of dollars today.

Every year, 100 Mohur coins are minted to the exact specifications as its 16th century predecessor by the East India Company. The 24-carat gold coin with a denomination of £1 can be pre-ordered for £1,195 here but, I’m sorry to break it to you, the latest version is already sold out. Maybe next year.

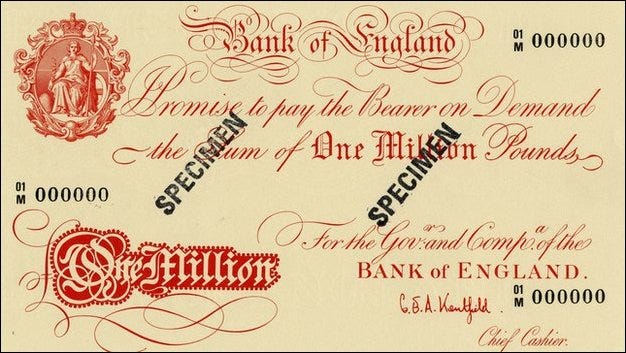

Million pound notes really do exist

If I asked you to name the highest denomination of a British banknote, you’d probably say £50. You’d be right but there was once a time when £1 million and £100 million notes were in circulation, known as ‘Giant’ and ‘Titan’ notes respectively.

The notes are not in active circulation but still play a vital role in the British currency system, by backing the value of the everyday notes issued by commercial banks in Scotland and Northern Ireland. These banks deposit an equivalent amount in sterling with the Bank of England for each of their own notes that they print. If any of the banks were to collapse, the value of their banknotes would be retained, guaranteed by the Bank of England.

These big-boy notes are printed internally, rather than by an external company, to maintain security and stored in vaults. Very occasionally, older £1 million notes have escaped from the Bank of England's archives (unlucky!). The note even features in Mark Twain’s short story, The Million Pound Bank Note, about a man who is given one of the Giant notes to settle a bet.

Further reading: The Bank of England’s website has a wealth of information on the history and design of banknotes in the United Kingdom. If you’re a nerd like me, I’d recommend having a scroll through its archive of historical banknotes. You can see what money looked like throughout the centuries, from denominations like the £1 note and £70 note, as well as emergency issues of currency during the wars.

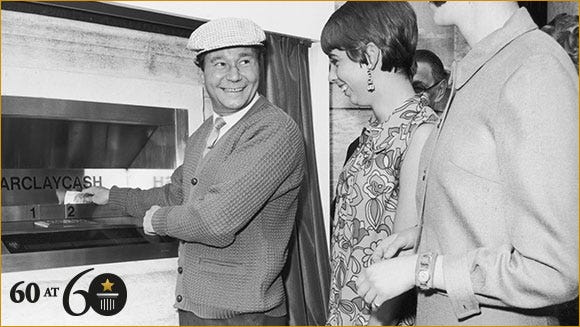

The world’s first ATM was in Enfield, London

ATM stands for automated teller machine and first appeared on the streets of north London, in Enfield, on 27th June 1967. It was invented by the engineering team led by John Shepherd-Barron of De La Rue, now the world's largest commercial printer of banknotes, who was later awarded an OBE.

Shepherd-Barron famously claimed that the idea for his invention came to him while having a bath:

"It struck me there must be a way I could get my own money, anywhere in the world or the UK. I hit upon the idea of a chocolate bar dispenser, but replacing chocolate with cash."

The inauguration of the first ATM - commissioned by Barclays bank - was led by actor, Reg Varney. The trial of ATMs had a huge celebrity endorsement to encourage customers to dispense their cash.

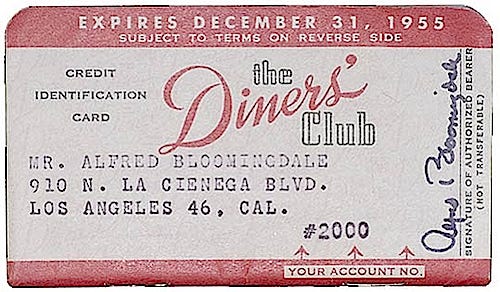

The idea of the credit card came from a forgotten wallet

Ahh a girl’s best friend, the humble credit card. The 1930s saw the inception of what we now know as the credit card, which actually started with dog-tag style metal plates that could be used in department stores.

Founder, Frank McNamara, is often attributed to the version of the credit card as we know it today after he forgot his wallet whilst at a restaurant, vowing to find a way to never let it happen again. He and his business partner, Ralph Schneider, launched the first Diners’ Club card in 1950 allowing restaurants to charge a customer’s meal to their card. Diners’ Club would send payment directly to the restaurant’s bank account, taking a small commission for each transaction and cardholders were required to pay their bill in full each month.

In its first year of operation, Diners’ Club grew from 10,000 members of New York’s business echelon, 28 restaurants and two hotels to more than 40,000 members across the United States.

Shortly after, in 1958, American Express had been founded and the rest they say is history.

The future of money

In our modern world, with the growth of cryptocurrencies, digital currencies and rise of cashless societies (of which Sweden is set to be the first), is physical money facing a slow death?

As a millennial, I haven’t (yet) dealt in gold coins but I’ve seen everything else - cash, cheques, credit and debit cards, contactless payments and QR codes. Although the use of technology to manage our wealth is only getting more commonplace and the move away from carrying cash is inevitable, there’s something about the tangibility of a banknote or coin that an old soul like me will always hold onto.

Sure, money has come a long way from cowrie shells and salt rations, but its evolution is a fascinating testament to the story of human innovation.

The next time you pull out your card or phone to make a payment, I hope you don’t forget the long, strange journey that brought us here.

Thanks for being part of picture this. If you like what you read, I’d truly appreciate it if you liked, shared, or left a comment - it makes all the difference.